ZenTDS || Process to Update Profile on TRACES Portal Through Software

TDS || Process of organization details, communication details, change password and register DSC and Authorized/responsible person changing at Traces portal :-

Before clicking This option previous filed return 01 challan and 3 TDS entries and Last filed return PRN number details must be have in software:

- How to feeding Previous Return PRN/RRR No : Click Here to Open

Navigate to Traces Activity:

Go to "Online Activity" → "Traces Activity" in the menu bar.

Go to "Update Profile" button:-

After click on Update Profile button then select Previous filed form option:-

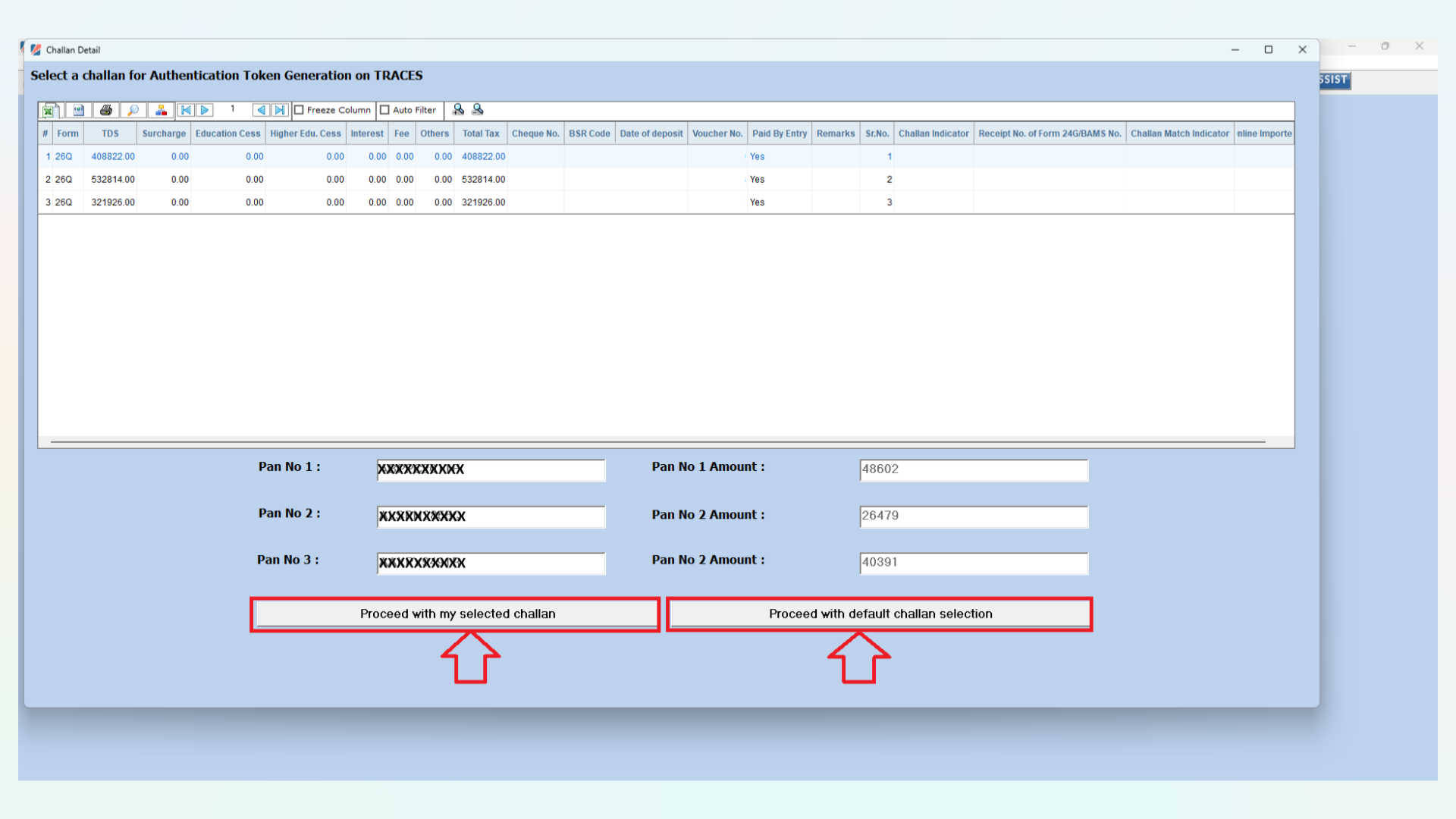

Select the challan or click on "Proceed with Default Challan Selection." The software will automatically select the challan with the maximum Deductee entries:

Click on Next button:

Software will be filed complete KYC details at Traces portal and profile page will be opened at Traces Portal:

In this Profile page you can change your organization details, communication details, change password and register DSC at Traces Portal.

Note: The TRACES profile page can be accessed through two options:

- Previous Return Filed KYC Details

- Digital Signature Certificate (DSC) (if registered)

If your DSC is registered, you can open the TRACES profile page using DSC. Click on the Profile button, and the DSC option will appear, allowing you to navigate the Profile

using DSC.

using DSC.

Hope This Helps.

Related Articles

Online Correction - Add Challan to Statement

This feature allows the deductor to add a challan to an already filed statement. The Add Challan functionality is not available through offline correction. If the statement is not processed by TRACES, please file C1 (Personal Information) through the ...ExpressTDS || Online Correction to Allocate Interest and Late Fee in TRACES Portal

This feature enables the deductor to add a challan to an already filed statement. The Add and Allocate Interest and Late Fee functionality is only available through online correction. Note that if the statement has not been processed by TRACES, this ...E-Tutorial || Deductor/ TAN Registration on TRACES Portal

E-Tutorial → Deductor Registration and Login Important Information on Deductor Registration and Login Brief Steps for Deductor Registration/Login on TRACES Important Information on Deductor Registration and Login A TAN can be registered on TRACES ...ExpressTDS || Online activity → Tag Challan on Traces Portal

Process for Tagging Mismatched Challans on the TRACES Portal (Applicable during Correction Return Filing in case of Challan Mismatch Errors) This guide outlines the step-by-step process to correctly tag unmatched challans on the TRACES portal via ...ZenTDS || How to Register Deductor on Reporting Portal for 206AB/CCA Verification

How to Register Deductor on Reporting Portal for 206AB/CCA Verification: Compliance Check for Section 206AB & 206CCA Background: The Finance Act of 2021 introduced Sections 206AB and 206CCA into the Income-tax Act, 1961, effective from July 1, 2021. ...