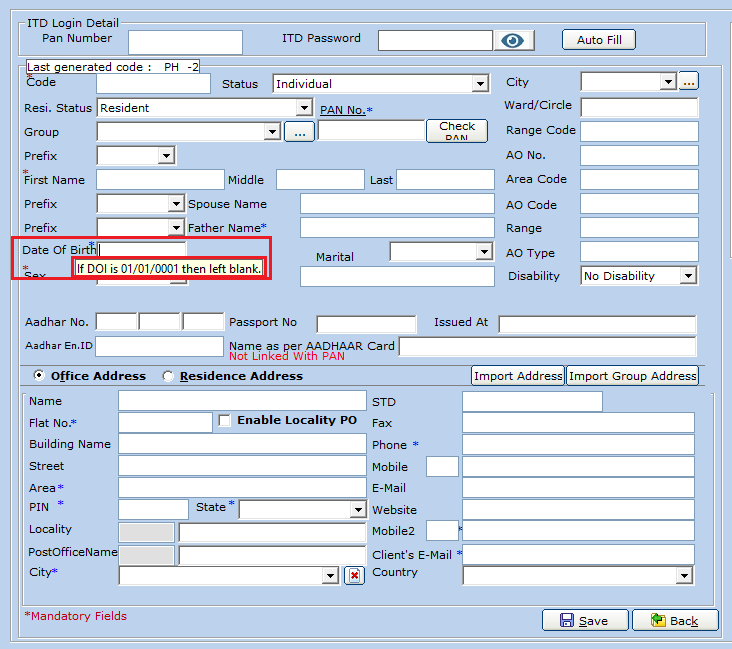

Error While Validation of Return || Date of incorporation is 01/01/0001

While

validating return date of incorporation 01/01/0001 is not accepted by the

software

Solution:

In the case

of HUF's which are ancestral the Date of Incorporation which is accepted by the

Income tax website is 01/01/0001 whereas the software taking DOI automatically

from master data.

So, we suggest you to leave blank - DOI column in client master and save

the data.Now, software will automatically take the following date "01/01/0001".

Hope this helps.Related Articles

Income Tax || Client Master Creation

The initial phase in software involves establishing foundational components referred to as masters, encompassing entities such as Client PAN, Client Name, Date of Birth (DOB), Status, and more. Now, let's explore the step-by-step process for creating ...26AS || TXT Not Imported due to incorrect DOB

Root Cause of the Error → This issue occurs when the downloaded 26AS ZIP file is not extracted. Solution → To correct this error, follow these detailed steps: Verify the Date of Birth (DOB): Check the Date of Birth (DOB) entered in the client master. ...Income Tax Auditor manual updation

If the client is using Spectrum software but wishes to update only the Income Tax Auditor, then: To resolve the error, please follow the steps provided below: Step 1: Navigate to the root location of the software, which can be either "C:\Program ...Billing || Client master Import from Income Tax / TDS

To initiate the import process for the Client Master, ensure that you first select the Consultant Master. Go to the Import form for Master Data, specifically designed for importing data from Income Tax or TDS Software. To access it, follow the menu ...Income Tax || Invalid Meta data error while Uploading form 3CD

While filing the tax audit return (Form 3CA-3CD/3CB-3CD), you may encounter an "Invalid Meta Data Error." Follow this process to resolve the issue: Possible Solutions: Membership Number: Go to Master >>Consultant Master >> Select Consultant: 1. ...