ExpressGST || Company Master Creation

Company Master Creation Guide:

In Express GST, a Client refers to a business entity or individual registered under the Goods and Services Tax (GST) that uses the platform to manage their GST compliance. Each client in Express GST has unique credentials and details that correspond to their GSTIN (Goods and Services Tax Identification Number).

This guide outlines two methods to create a Client Master in the application:

Using GSTIN Credentials (For Single Client) → Use GSTIN Username and GSTIN Password to create the client.

Via Excel Upload (For Bulk Import) → Upload an Excel file with the required client information.

Creating a Client Master Using GSTIN Credentials

Step 1: Log into the software and select the "Add Company Name" option.

Step 2: A form will open, prompting you to enter the following details:

- GSTN Username: Enter the client's GSTIN username.

- GSTN Password: Enter the corresponding password.

- Captcha: Input the captcha code as displayed on the screen.

Step 3: After entering the required information, click Save to add the client.

The new client will now appear in the Client Master list.

Creating a Client Master via Excel Upload

Step 1: Log in to the ExpressGST portal and navigate to the Client Master page, where all clients are listed.

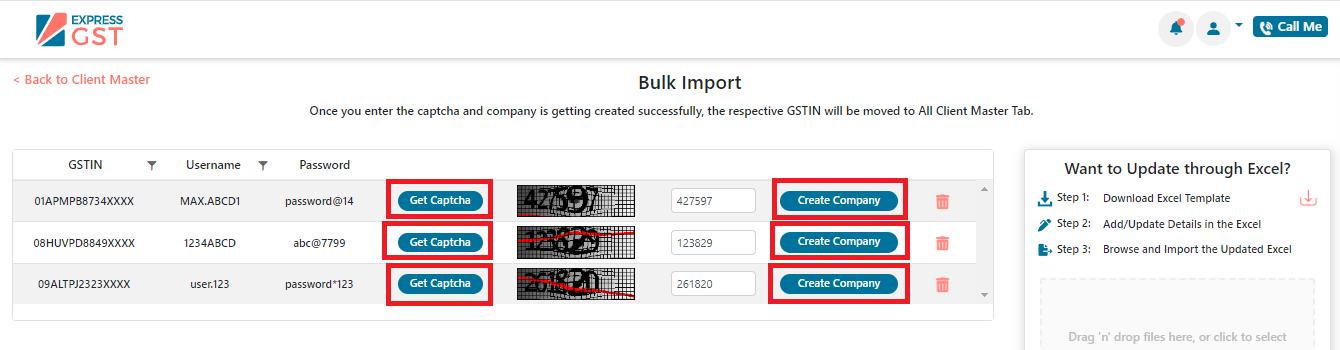

Step 2: To add multiple clients at once, click on "Bulk Import".

Step 3: Click the Download button to download the blank excel template.

- GSTIN

- Username

- Password

Step 5: Save the updated Excel file on your computer.

Step 6: On the ExpressGST platform, click Select File and choose the Excel file you just edited. Then click Open.

Step 7: To import the file, click Import button.

Step 8: A summary window will appear, displaying the records successfully imported and any that were rejected due to invalid GSTN, username, or password.

Step 9: To complete the process, click Okay.

Step 10: After completing these steps, all clients will be added to the Client Master via Bulk Import, and their details, including GSTN, username, and password, will be listed.

Step 11: Click on Get Captcha, enter the captcha shown in the screen and click on "Create Company" option.

By following this process, you successfully import clients in Client Master as Bulk Import.

Related Articles

ExpressReco || Client Master Creation Guide

This guide provides step-by-step instructions on adding a Client Master to the system using two methods: Using ITD Credentials – Authenticate and add clients with ITD login details. Via Excel Upload – Bulk upload client details using an Excel ...ExpressTDS || Deductor master creation

Deductor Master Creation Guide for ExpressTDS This guide provides instructions on how to create a Deductor Master in ExpressTDS using three methods: Using ITD Credentials: Add deductors by entering ITD login details. Bulk Excel Import: Create ...Income Tax || Client Master Creation

The initial phase in software involves establishing foundational components referred to as masters, encompassing entities such as Client PAN, Client Name, Date of Birth (DOB), Status, and more. Now, let's explore the step-by-step process for creating ...TDS || Deductor's Master Creation and Edit Deductor's Master Process

The initial phase in software involves setting up foundational elements known as masters, which include entities like Deductor, Deductee, Employee, DDO master, etc. Now, let's delve into the step-by-step process for creating the Deductor master: ...ExpressTDS || Employee/Deductee master Creation

How to Create Employee/Deductee Master in ExpressTDS Step 1: Visit www.expresstds.com and log in with your username and password and navigate to the Deductor Master page. Choose the relevant company or deductor from the list of deductors. Step 2: On ...